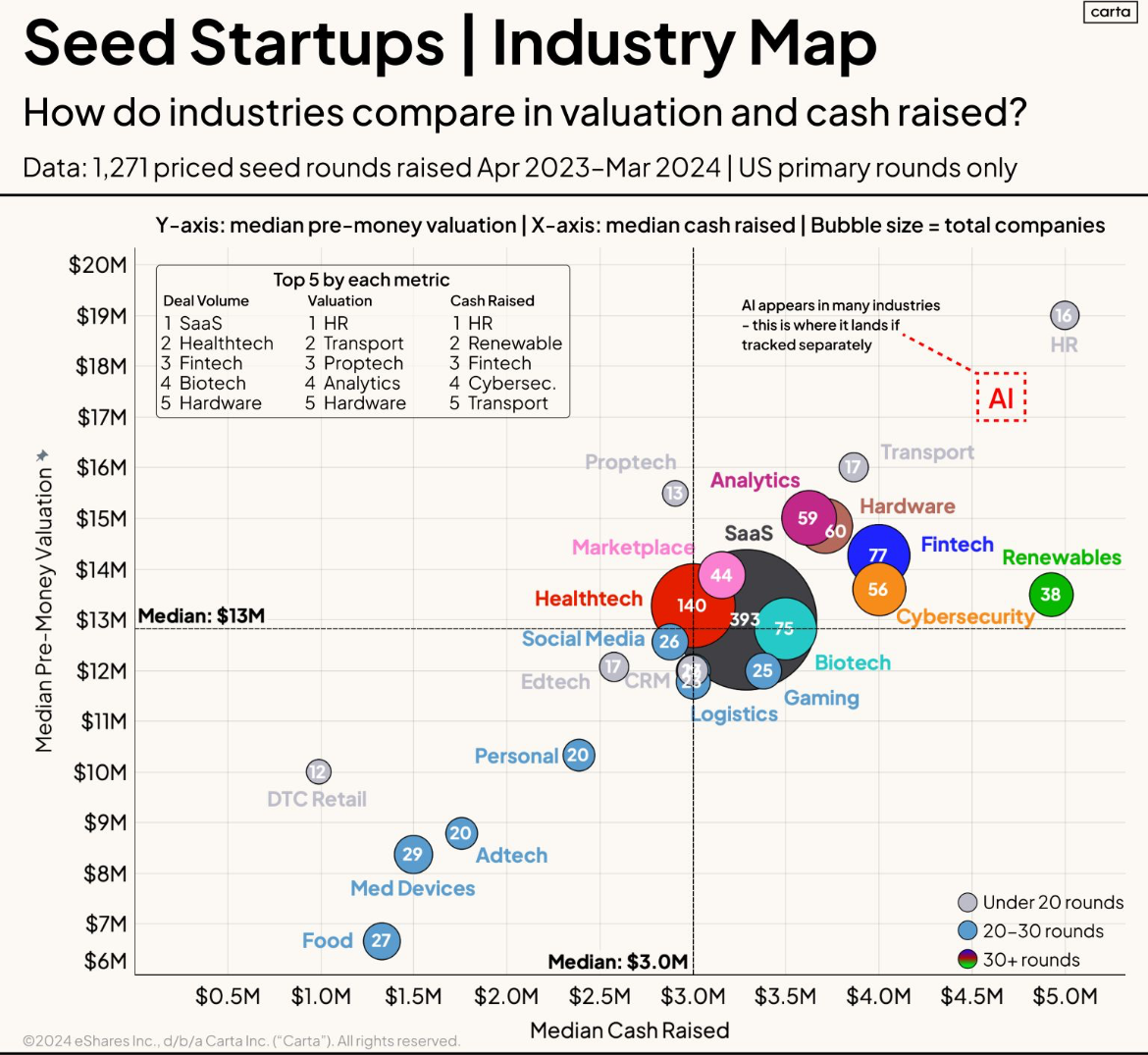

If you’re a startup and have ever had the discussion of fundraising you’ve most likely been told to attempt a pre-seed or seed-stage fundraise. This is an interesting stage for startups as it’s when you’ll gain capital to improve whatever you’ve already built. However, seed-stage fundraising is changing everyday as is everything else and it’s becoming a massive wave of fluctuation depending on the startup industry. By examining data from 1,271 priced seed rounds raised between April 2023 and March 2024 in the U.S., we can see the trends across different sectors…

Healthtech Surpasses Fintech

Given the data, one of the biggest shifts is that Healthcare is overtaking Fintech as the second-largest category. It’s not a surprise since the idea behind all Fintech companies is the same, right? The shift shows that investors are more confident in the impact health-related technologies bring to the table. Ever since the global pandemic, people have been diving into the advancements in digital health, personalized medicine, and biotechnology. Healthcare startups are raking in substantial seeding funding to innovate and expand. One of our favorite healthcare related startups is Tebra, check em out.

The Resilience of AI

We know you’ve gotten sick and tired of seeing “AI this,” and “AI that,” so have we. However, while it’s been over-used and embedded in so many industries, it consistently stands out in the fundraising metrics. If you were to make AI a separate industry, it would top every list. Modern innovation wouldn’t be the same without it as shown in its resilience and for that we have to at least give it a pat on the back.

AI also stands out when we see Seed volume declining. Across the board of all categories and industries, seed volume has declined. Want to know which category is an exception? AI. More seed deals are being completed on Simple Agreement for Future Equity (SAFE) notes, although the valuations and cash raised remain similar to priced rounds by industry.

The Rise of Alternative Funding Strategies

The startup “ecosystem” (more like a clique) has involved concepts such as “venture stripping” or “single round VC.” These strategies put the focus on having revenue driving growth so then founders can go out with the focus of only raising one round of funding. It’s seen as a “cool and viable” strategy, especially for founders looking for sustainable growth and the title of “unicorn.”

Many people on the counter side of this ask if the new strategy can produce a ton of $1Bn valuation companies. It’s not something we can say yes or no to, however, it’s clear the approach is gaining traction.

Will These Startups Ever Raise a Series A?

With new trends emerging and disparities within the fundraising realm a major question comes into the room: Will these seed-funded companies ever advance to Series A? The shift towards alternative funding strategies and the declining volume of seed deals in several categories suggest that some startups might opt out of traditional VC funding altogether.

Takeaways

Seed-stage fundraising is changing. There are ridiculous negatives but there are also amazing positives in terms of emerging trends and fundraising strategies. Healthtech’s rise, AI is staying solid despite becoming a buzzword, and the revenue-based growth model is becoming the norm. All of these show the nature of startup financing. It’s messy and ever-changing. As the ecosystem continues to adapt, it’ll be nice to see which strategies and sectors lead the next wave of innovation and growth.

Ready To Scale Your Startup In 2024? Check Out Be Uniic's Free Audit Bundle Today!